Sustainability at Crossroads: Managing Risk Before Regulation

Issue #26 of Top Picks in Strategy and Sustainability.

Welcome to this week’s Sustainability Roundup!

As climate ambition collides with economic reality, sustainability is being reshaped by regulation, resilience, and rising execution risk. From Europe’s attempt to formalise carbon removals, to India’s development-first climate stance, and suppliers overwhelmed by ESG demands, this week’s signals point to a clear shift: sustainability is being tested less by ambition and more by its ability to function inside real-world constraints.

Find out more below! 🌱

1. EU Adopts World First Voluntary Standard for Permanent Carbon Removals

The European Commission’s new certification framework under the Carbon Removals and Carbon Farming Regulation brings long needed structure to carbon removal markets, but it also risks legitimising an immature asset class before scale, cost, and permanence challenges are resolved. While standardisation may curb greenwashing, it could also accelerate corporate dependence on removals as a substitute for deep emissions cuts, particularly given the limited supply and high cost of durable options like Direct Air Capture. By setting a global benchmark, the EU raises credibility thresholds, but also risks locking climate strategy into capital intensive solutions that may delay near term mitigation rather than complement it.

2. India Refocuses Climate Policy Around Development, Resilience and Energy Security

India’s evolving climate strategy is recalibrating around economic development, resilience building and energy security rather than narrow emissions targets, signaling a shift from traditional mitigation - centric frameworks toward holistic socio-economic priorities a pragmatism reflecting capacity constraints and global trade-off realities as captured in the country’s recent policy discourse. This repositioning underscores that climate action must harmonise with development imperatives, but risks diluting emission reduction urgency if not balanced with robust accountability mechanisms challenging conventional decarbonisation timing and ambition.

3. Suppliers Are Drowning in ESG Requests Coming into 2026

Manufacturers and suppliers are facing an unprecedented surge of overlapping ESG data and compliance requests, revealing that sustainability transparency expectations have now become an operational bottleneck rather than a simple reporting exercise. While this reflects maturation of sustainability demand, it also exposes a critical infrastructure gap as suppliers struggle with fragmentation, risking slower product innovation and strained buyer-supplier relationships unless standardised systems and tools emerge to streamline these requirements.

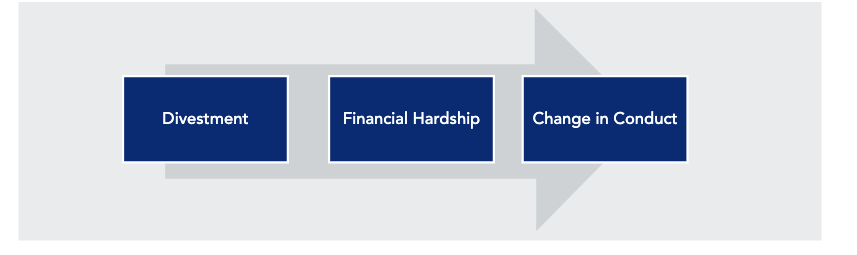

Academic research on climate transition risk shows that corporate exposure to decarbonisation pressures often unfolds through indirect pathways rather than direct regulation. Work on stranded assets and climate related financial risk demonstrates that pressure typically moves sequentially from investor divestment, to financial hardship, and finally to forced changes in corporate conduct, a dynamic that becomes particularly acute when carbon intensity is embedded in value chains rather than owned assets.

Figure 1: Ansar, Caldecott and Tilbury, Stranded assets and the fossil fuel divestment campaign, University of Oxford.

The diagram illustrates how transition risk accumulates invisibly before it becomes operationally disruptive. For companies with high Scope 3 emissions, early signals such as capital withdrawal or rising supplier costs often precede regulatory intervention, leaving little time to adapt once conduct change becomes unavoidable. Firms may appear resilient based on Scope 1 and 2 metrics, while remaining structurally exposed through suppliers, logistics networks, and downstream product use.

The research highlights that disclosure alone does not interrupt this sequence. Without proactively reducing carbon embedded in value chains, companies risk being pushed into reactive transformation under financial stress rather than steering an orderly transition.

The implication is clear: Scope 3 emissions act as a transmission channel for transition risk. Companies that address them early retain strategic flexibility, while those that delay face externally imposed change on unfavorable terms. Read more here.

Watch how material science, testing protocols, and end-of-life systems, not marketing claims, determine whether biodegradable products deliver real environmental benefit. It reveals how brands often conflate bio-based inputs with true biodegradability, obscuring ongoing microplastic and waste risks.

The analysis highlights a core strategic constraint: product sustainability is limited less by ambition than by infrastructure, standards, and trade-offs between durability and degradation. When systems lag ambition, sustainability positioning stops creating strategic value and starts amplifying trust and execution risk.

Last week’s poll results show 57% view sustainability as primarily risk control and 43% say it depends on the sector, the results suggest risk management is becoming the default entry point. Transformation remains possible, but only where industry economics allow sustainability to move beyond compliance. View our last post here.

Missed our recent issues? Catch up anytime by reading our full archive here 📖.

That’s it for today’s roundup! We’ll see you next Thursday with another set of inspiring sustainability news and updates. Until then, take a moment to reflect on how you can adopt one new sustainable practice this week. Every small step counts! 🌍✨

Have any thoughts or a sustainable practice you'd like to share? Share your feedback here.

Together, we can make a difference. See you in the next edition of the Sustainability Roundup!

Solid breakdown on the biodegradability gap. The point about conflating bio-based sourcing with actual degradation timelines is something I've seen trip up companeis at the procurement stage. When infrastructure lags behind marketing claims, businesses get stuck wiht compliance risk and consumer backlash. It's kinda wild how much operational friction comes from chasing labels instead of verifying decomposition pathways first.

Here’s a new idea that could help us bridge the sustainability gap, what do you think?

https://substack.com/@micahblakeallred/note/p-187458050?r=623izf&utm_medium=ios&utm_source=notes-share-action