Is Sustainability Long Term Risk Management? PepsiCo CEO Suggests

Issue #25 of Top Picks in Strategy and Sustainability.

Hi There! 👋

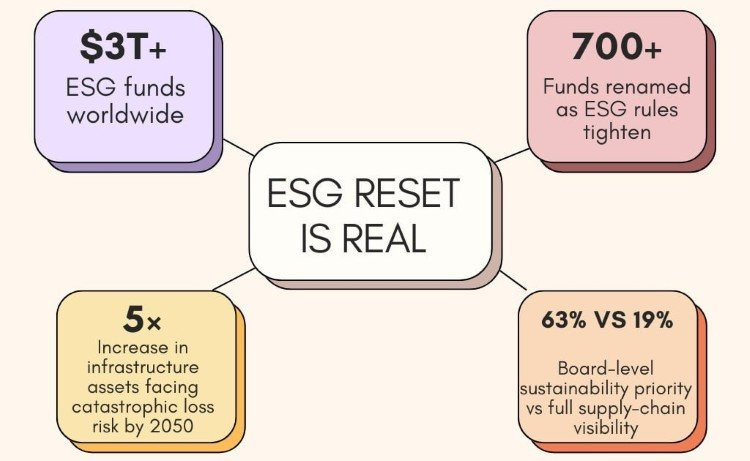

This week’s Sustainability Roundup reflects a maturing sustainability landscape, where data, regulation and risk management are reshaping how climate and nature commitments are judged. From the widening gap between nature negative and nature positive finance, to Europe’s crackdown on greenwashing and corporates reframing sustainability as long term risk management, the emphasis is shifting from intent to credibility, execution and accountability.

Let’s dive in! 🌱

1. UN Report Reveals 30:1 Imbalance in Nature Negative vs Nature Positive Funding

The UN’s State of Finance for Nature 2026 report reveals a stark misalignment in global capital flows, showing that for every one dollar invested in nature protection, thirty dollars continue to fund activities that degrade ecosystems, amounting to nearly seven trillion dollars in nature negative finance. While awareness of nature based solutions is rising, the private sector contributes only ten percent of total NbS funding, reinforcing criticism that voluntary corporate commitments are structurally insufficient to halt biodiversity loss. Regulators and financial institutions are likely to accelerate mandatory nature related disclosures and capital screening, forcing investors to reassess exposure to nature intensive sectors such as industrials, infrastructure and utilities.

2. EU Formalizes Stricter Rules Against Corporate Greenwashing

The European Parliament has approved a directive banning vague environmental claims such as carbon neutral or eco friendly unless backed by robust, verified evidence, marking one of the strongest global moves against greenwashing. While the rules strengthen consumer protection and reward credible sustainability performance, critics warn that compliance complexity and certification costs could disadvantage smaller firms and slow innovation. Sustainability claims now sit squarely within legal and reputational risk management, requiring companies to tightly integrate ESG performance, data assurance and marketing strategy to protect brand value and market access.

3. PepsiCo CEO Calls for Reframing Sustainability as Long Term Risk Management

At Davos, PepsiCo CEO Ramon Laguarta argued that sustainability should be treated as a long term risk management discipline focused on resource security, cost volatility and supply chain resilience rather than a profit versus planet trade off. However, this narrative shift coincides with PepsiCo extending its net zero target from 2040 to 2050, prompting criticism that strategic realism is being used to justify slower climate ambition. More companies may recalibrate climate targets toward longer timelines and operational resilience, raising scrutiny over whether strategic discipline is strengthening transition credibility or quietly diluting urgency.

The Value Chain Carbon Transparency Framework hardwires sustainability into core business strategy by moving decisively beyond high-level ESG disclosures toward product and supplier level emissions intelligence that actually drives decisions. Instead of managing abstract corporate averages, it gives leaders visibility into where carbon truly sits across the value chain, allowing them to act on the real sources of cost volatility, regulatory exposure and competitive advantage.

Three Steps to Map Value Chain Emissions:

Step 1 - Identify where carbon really lives

Start by mapping emissions across Scope 1, Scope 2 and the most material Scope 3 categories, with particular focus on raw materials, manufacturing partners, logistics and product use. For most businesses, Scope 3 dominates the footprint, making early prioritisation essential rather than optional.

Step 2 - Turn suppliers into a strategic decarbonisation lever

Move quickly beyond spend-based proxies to supplier specific and product level emissions data by engaging priority suppliers directly. This shifts sustainability from a reporting obligation into a procurement and performance management tool, enabling targeted interventions where they matter most.

Step 3 - Make carbon data change commercial decisions

Embed emissions intelligence into sourcing, product design, pricing and capital allocation so decarbonisation supports margin protection, resilience and growth. Product level carbon visibility strengthens the credibility of sustainability claims while positioning companies to meet tightening regulation and rising investor scrutiny.

Value chain carbon transparency is not about better reporting, it is about better management. Companies that operationalise emissions data across everyday decisions will be the ones that reduce transition risk fastest, defend competitiveness under regulation, and turn decarbonisation from a compliance cost into a source of long-term enterprise value.

Read how carbon accounting trends are settling in this year, from new sustainability vocabulary and shifting standards to a rapidly evolving reporting and data landscape.

This resource unpacks how companies are moving from fragmented ESG metrics toward interoperable, decision grade carbon data, and what this means for strategy, governance and credibility as scrutiny tightens across markets. Read it here.

Last week’s poll shows strong scepticism toward blanket green growth narratives, with 56% prioritising impact over growth and 44% limiting decoupling to select sectors. Strategically, this signals rising pressure on companies to prove real environmental outcomes rather than rely on growth led sustainability stories, especially in high impact industries. Missed our last poll? Read here.

Missed our recent issues? Catch up anytime by reading our full archive here 📖.

That’s it for today’s roundup! We’ll see you next Thursday with another set of inspiring sustainability news and updates. Until then, take a moment to reflect on how you can adopt one new sustainable practice this week. Every small step counts! 🌍✨

Have any thoughts or a sustainable practice you'd like to share? Share your feedback here.

Together, we can make a difference. See you in the next edition of the Sustainability Roundup!