Japanese firms lead global climate performance, data shows

Issue #23 of Top Picks in Strategy and Sustainability.

Welcome to this week’s Sustainability Roundup!

This week we highlight a clear shift sustainability is no longer advancing through ambition alone but through how decisively companies redesign their decision systems. From climate transition plans being tested by supply chain realities to AI bringing nature risk into the boardroom and evidence showing why governance design separates leaders from laggards the common thread is execution. The advantage now lies with organisations that treat sustainability as a core management capability rather than a parallel initiative shaping risk resilience and long term value creation.

Dive in for more! 🌱

1. eBay Unveils First Climate Transition Plan Targeting Net Zero by 2045

eBay has released its first formal climate transition plan with Science Based Targets validation committing to net zero emissions by 2045 and highlighting progress on operational emissions while acknowledging the complexity of reducing Scope 3 logistics and supplier impacts. The plan reflects growing investor pressure for credible pathways rather than distant pledges but also exposes how much corporate decarbonisation still depends on partners and infrastructure outside direct control. This reinforces climate transition plans as a strategic licence to operate yet shows that without sector wide coordination voluntary plans risk becoming signalling tools rather than system level change drivers.

2. Japanese Companies Lead Global Climate Leadership Rankings

New CDP data shows Japanese companies outperform peers globally on climate leadership driven by higher adoption of science based targets and tighter governance links between executive incentives and emissions performance. The results suggest climate performance is less about geography and more about management systems yet also reveal uneven global standards that allow laggards to compete without equivalent ambition. Strong internal governance can compensate for weak external regulation but fragmented global benchmarks risk rewarding form over substance across markets.

3. AI Moves Nature Risk Into the Corporate Boardroom

Companies are increasingly using AI tools to translate complex biodiversity and land use data into decision ready insights enabling nature related risks to be integrated into strategy capital planning and disclosures. While this marks a leap forward in operationalising nature it also raises concerns about data transparency energy intensity and access for smaller firms. AI can accelerate the mainstreaming of nature risk into strategy but may widen the sustainability capability gap unless standards and access are broadened.

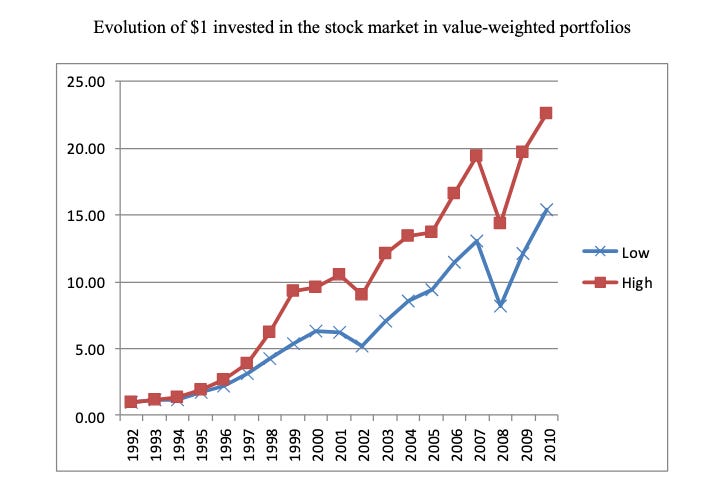

Eccles Ioannou and Serafeim show that sustainability only delivers value when it is treated as a management architecture choice not a values statement. Their longitudinal study of 180 firms over nearly 20 years found that high sustainability performers rewired governance incentives and decision rules which translated into stronger long term returns and greater resilience during downturns. The difference was not commitment but design.

How sustainability shows up in winning management systems:

From oversight to ownership

High performing firms move sustainability out of functional silos and into board and executive ownership where strategic tradeoffs are made. This ensures environmental and social considerations influence capital allocation acquisitions and growth priorities rather than being reconciled after decisions are locked in.From short term optimisation to long term advantage

These companies deliberately extend decision time horizons allowing investments that reduce volatility and risk to compete fairly with short term financial returns. Sustainability becomes a way to protect future cash flows rather than a cost to be justified.

Figure 1 shows that firms embedding sustainability into governance and decision-making significantly outperform low-sustainability peers over time, demonstrating sustainability as a source of long-term financial advantage rather than a cost.

From stakeholder noise to strategic signal

Rather than reacting to external pressure high sustainability firms institutionalise stakeholder engagement as an early warning system. This converts social and environmental issues into foresight inputs that improve strategy quality.

Sustainability scales when it is built into how leaders evaluate risk reward and performance not when it relies on conviction alone. Read in detail here.

Listen to how climate change is outpacing the tools economists and decision makers rely on creating dangerous blind spots in how risk is forecast and disruption is priced.

The discussion makes a clear case for why leaders must move beyond static models and adopt science driven approaches such as simulations and digital twins to build strategies that remain resilient under accelerating climate volatility.

Last week’s poll shows 83% of respondents expect verified or full lifecycle proof for sustainability claims, signalling shrinking tolerance for material-only narratives and rising expectations for evidence-led credibility. Missed our last post? Read here.

Missed our recent issues? Catch up anytime by reading our full archive here 📖.

That’s it for today’s roundup! We’ll see you next Thursday with another set of inspiring sustainability news and updates. Until then, take a moment to reflect on how you can adopt one new sustainable practice this week. Every small step counts! 🌍✨

Have any thoughts or a sustainable practice you'd like to share? Share your feedback here.

Together, we can make a difference. See you in the next edition of the Sustainability Roundup!