France Bans PFAS - 'The Forever Chemical'

Issue #24 of Top Picks in Strategy and Sustainability.

Hello there! 👋

From France drawing hard regulatory lines on toxic chemicals, to oceans being governed beyond borders, to investors questioning how far climate ambition can stretch before credibility breaks, sustainability is no longer about incremental improvement. The common thread is choice: what companies are willing to change, what trade-offs they accept, and where growth itself may need redesign rather than optimisation.

Let’s dive in! 🌱

1. France Bans PFAS in Consumer Products Forcing Industry Reform

France’s January 2026 ban on PFAS across textiles, cosmetics, and other consumer products pushes brands to accelerate safer chemistry adoption, highlighting regulatory risk for companies reliant on “forever chemicals.” This puts a hard deadline on chemical risk management but also exposes supply chain vulnerabilities for firms unprepared for rapid reformulation and regulatory divergence. The ban redefines chemical governance expectations for global brands yet compliance will demand substantial investment in alternatives and verification systems, with potential cost and timeline implications.

2. High Seas Treaty Enters Into Force with Real Time AI Tracking Sustainable Seafood

The United Nations High Seas Treaty became legally binding January 17, enabling marine biodiversity governance beyond national jurisdictions while innovators deploy AI to monitor fishing sustainability in real time, drastically improving transparency and enforcement. This landmark marries policy with advanced tech to tackle overfishing, yet effectiveness will hinge on equitable implementation across coastal and distant-water fishing fleets. Companies in seafood supply chains must now integrate treaty compliance and AI-enhanced traceability into sourcing strategies but enforcement gaps and technology access inequities could limit environmental outcomes.

3. Norway’s Oil Fund Pushes for Looser Net Zero Rules

Norway’s $2 trillion sovereign wealth fund says climate targets aligned with 1.5°C are so strict that many companies may stop engaging altogether, and argues that allowing 2°C pathways could keep more firms involved in climate action. Critics warn this risks lowering ambition at a time when climate impacts are accelerating and global standards already lack consistency. Investors and companies must choose between keeping more firms “in the tent” with softer rules or protecting credibility by sticking to tougher science based targets that fewer companies can meet.

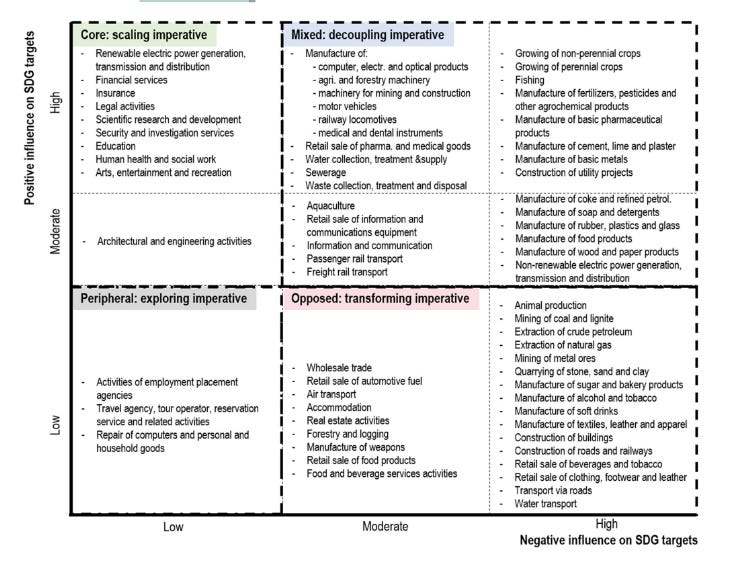

Jan Anton van Zanten and Rob van Tulder (Rotterdam School of Management, Erasmus University Rotterdam) challenge the assumption that economic growth and sustainability performance naturally improve together. Their research shows that many companies remain structurally linked to social and environmental harm even as revenues grow.

Figure 9: Jan Anton van Zanten and Rob van Tulder, Four Corporate Sustainability Imperatives, Rotterdam School of Management, Erasmus University Rotterdam.

The diagram illustrates that most firms achieve only relative decoupling, where impacts increase more slowly than business activity but continue to rise in absolute terms. This creates a perception of progress without changing the underlying trajectory. True decoupling emerges only when companies deliberately redesign how value is created, such as shifting product portfolios, changing business models, or exiting impact-intensive activities.

The authors also show that efficiency improvements and enhanced reporting can improve performance metrics but rarely alter strategic direction. Meaningful progress requires explicit choices about where growth should come from and which activities are incompatible with long-term sustainability.

For managers, the insight is clear: decoupling is not an operational outcome but a strategic positioning challenge. Companies that treat sustainability as a growth design issue, rather than an optimisation exercise, are more likely to deliver durable impact. Read the full paper here.

Listen as leaders confront a question most sustainability strategies avoid: whether efficiency-led growth can survive planetary limits. By exposing the limits of decoupling and the Jevons Paradox, the discussion reframes sustainability from optimisation to managing growth within ecological boundaries.

For businesses and investors, this reframes sustainability from an optimisation exercise to a boundary-management challenge, where long-term value creation depends on operating within ecological limits rather than expanding output indefinitely.

Last week’s poll signals momentum toward linking sustainability to pay and capital decisions, but the split highlights demand for sector-specific metrics rather than rigid, one-size-fits-all incentive models. Read here.

Missed our recent issues? Catch up anytime by reading our full archive here 📖.

That’s it for today’s roundup! We’ll see you next Thursday with another set of inspiring sustainability news and updates. Until then, take a moment to reflect on how you can adopt one new sustainable practice this week. Every small step counts! 🌍✨

Have any thoughts or a sustainable practice you'd like to share? Share your feedback here.

Together, we can make a difference. See you in the next edition of the Sustainability Roundup!

Strong piece on the decoupling problem. The van Zanten framework nails why relative improvements can mask absolute growth in environmental impact. Worked in supply chain consulting and can attest France's PFAS ban is gonna create reformulation chaos most companies aren't prepped for. Norway's fund arguement about keeping laggards engaged versus maintaining 1.5C credibility really captures the core dilemma.