Apple Watch ‘CO2-Neutral’? Court Says Think Again

Issue #5

Hi there 🌍✨

This week, the sustainability spotlight falls on the strength and fragility of our systems. From EU forests turning from carbon sinks to carbon sources, to India’s annual climate finance gap, to Apple’s courtroom clash on “CO₂-neutral” claims, the message is clear: resilience isn’t built on quick fixes. It’s built on relationships trust, reciprocity, and shared purpose the core of Relational Governance.

1. EU’s Record Wildfire Emissions Expose Fragility of Forest Carbon Sinks 🌳🔥

Unprecedented wildfires across the EU have burned over 1 million hectares and released more than 38 million tonnes of CO₂ in 2025 alone, over double the 20-year historical average. This has transformed forests from dependable carbon sinks into net-carbon sources, eroding natural climate buffers and exposing the fragility of nature-based solutions as a sole mitigation lever.

2. India’s Climate Finance Needs Projected to Reach Billions Annually 💸

A CSEP study finds that India will need about 467 billion dollars in climate finance between now and 2030 to decarbonize hard-to-abate sectors like steel and cement. This works out to around 54 billion dollars every year, equal to about 1.3% of India’s GDP. The scale of this gap highlights both urgency and opportunity. Mobilizing domestic and global capital into decarbonization is critical, positioning India as a potential hub for climate-focused investment and innovation.

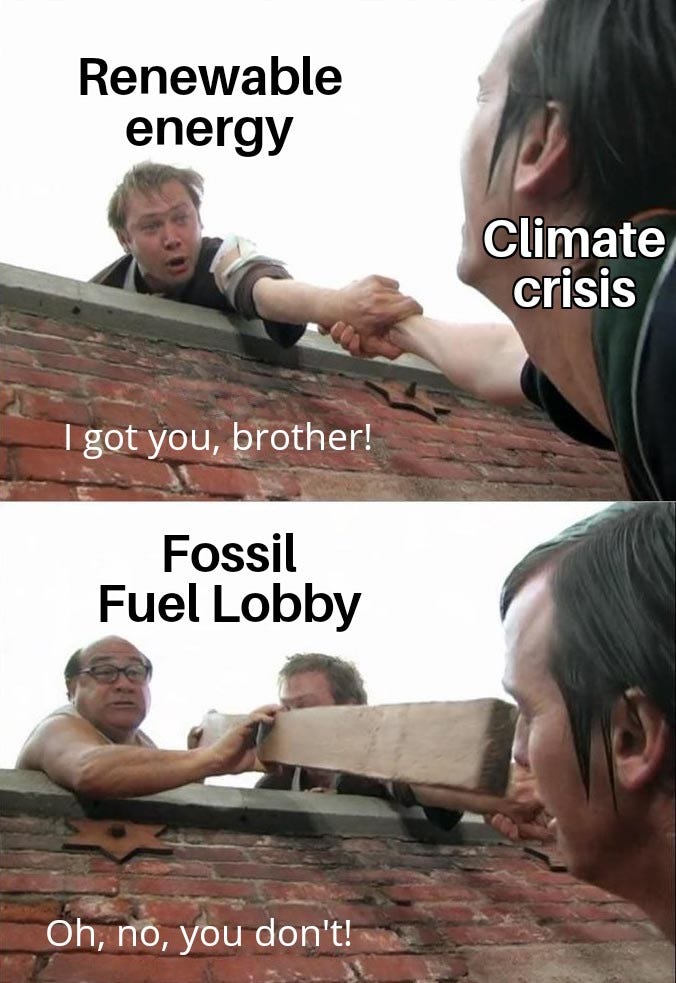

3. Apple Watch Deemed “Not CO₂-Neutral” by German Court ⌚🚫

A German court barred Apple from marketing the Apple Watch as “CO₂-neutral,” ruling its carbon offset project in Paraguay is unreliable and ecologically flawed. The decision marks a landmark against greenwashing in consumer products. This ruling signals a stricter regulatory climate where unverifiable offset use becomes a direct legal and reputational liability, not just a communication risk.

This week’s focus is on relationships, the sustainable ones. Relational Governance (RG) is a strategic framework that helps organizations build and maintain trust-based, transparent, and mutually beneficial relationships with key stakeholders, including suppliers, partners, employees, communities, and investors. Unlike transactional or purely compliance-driven approaches, RG treats relationships as relational capital, leveraging information sharing, reciprocity, and shared purpose to create resilience and long-term value. 🤝

To integrate this framework, map your stakeholder networks, assess information asymmetries, and establish open communication channels. Build mechanisms for joint problem-solving and reciprocity, ensuring partnerships evolve with changing needs while strengthening social license to operate. This positions your organization to thrive through durable, trust-driven alliances that align business goals with community wellbeing.🌐

Read how RG can be seen in agricultural value chains in Pakistan, where partners collaborate by sharing data, providing technical support, and making long-term commitments. The study found that contracted farms had a benefit–cost ratio of 1.71 compared to 1.22 for non-contracted farms, showing higher returns. These relational governance practices boost transparency, capacity, and mutual benefits leading to higher yields, lower environmental impact, and stronger rural livelihoods. Read more here.

Sustainable relationships are strategic assets vital to leadership and organizational longevity. Relationships with suppliers and communities hinge on information, transparent, timely, and reciprocal. Sharing knowledge openly builds trust, enables fairness, and strengthens resilience across value chains and ecosystems.

Information is relational capital 💎. When organizations practice open communication and knowledge partnerships, they turn transactions into sustainable alliances. Just as communities thrive on trust, reciprocity, and shared purpose, businesses must align values, adapt together, and foster authentic stakeholder ties ensuring resilience, competitiveness, and long-term harmony.

📊 Results from our latest poll reveal a strong shift toward holding investors accountable for environmental harm caused by companies they fund, 75% of respondents believe investors should be fully responsible for environmental harm, while 25% advocate for shared accountability. This reveals a strong strategic expectation for investors to move beyond passive financing and play an active role in enforcing environmental standards, signaling a new era of sustainability governance and risk management. Read our last issue here.

Missed our recent issues? Catch up anytime by reading our full archive here.

That’s it for today’s roundup! 🌱💡 We’ll see you next Thursday with another set of inspiring sustainability news and updates. Until then, take a moment to reflect on how you can adopt one new sustainable practice this week. Every small step counts!

Have any thoughts or a sustainable practice you'd like to share? Share your feedback here.

Together, we can make a difference 🌍💚. See you in the next edition of the Sustainability Roundup!